Table of Contents

Introduction

Managing finances can be a challenge, especially for individuals with ADHD. The right tools can make a significant difference. In this post, we will explore the best budgeting apps for ADHD, providing you with the insights needed to take control of your finances and develop healthy financial habits.

YNAB

YNAB is one of the best budgeting apps for ADHD due to its user-friendly interface and effective budgeting principles.

Pros:

- Easy-to-use UI.

- Syncs bank data from multiple sources.

- Encourages giving every dollar a job.

- Tracks savings month-to-month.

Cons:

- Subscription-based.

- Loss of data after unsubscribing.

YNAB has been my personal favorite. Its design and functionality helped me develop better financial habits. However, be mindful of the subscription cost and potential data loss if you unsubscribe.

YNAB uses a zero-based budgeting approach, which means you assign every dollar a specific job. This method can be particularly helpful for individuals with ADHD as it provides a clear structure and reduces impulsive spending. Additionally, the app offers educational resources and community support to help you stay on track. For those looking for the best budgeting apps for ADHD, YNAB stands out with its unique approach to personal finance.

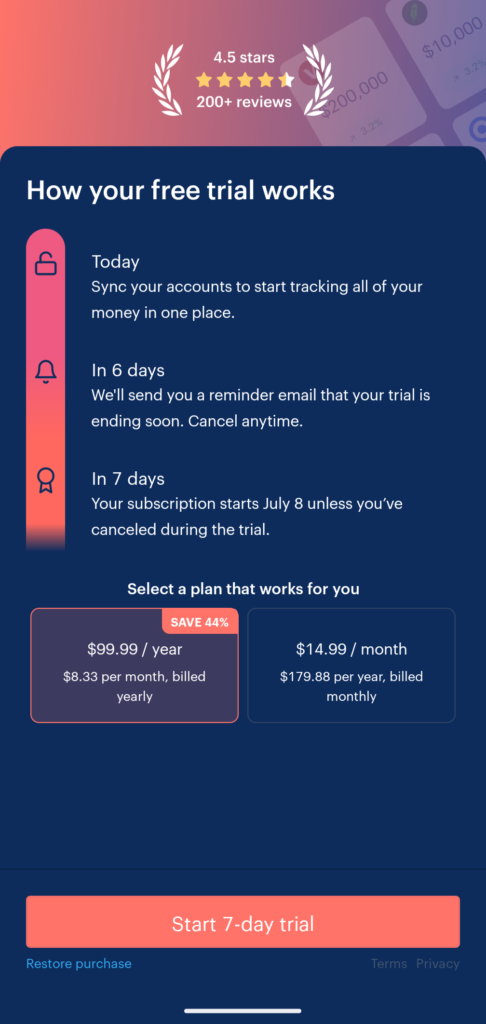

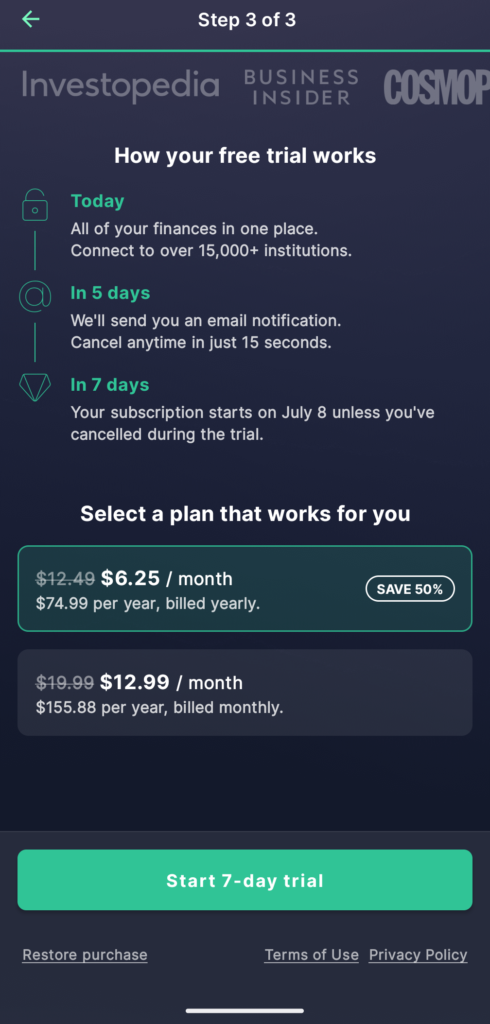

Monarch Money

Monarch Money is an all-in-one financial management tool, making it a top choice for ADHD individuals who need a holistic view of their finances. The app allows you to connect all your bank accounts, credit cards, bills, and investments in one place. It then categorizes your transactions and provides insights into your spending habits.

Pros:

- Simple, clear interface.

- Focuses on spendable income.

- Bank-level security.

- Tracks spending and helps identify saving opportunities.

Cons:

- Subscription-based.

- Limited customization without premium features.

One of Monarch Money’s standout features is its financial planning tools. You can set up customized budgets and financial goals, such as saving for a vacation or paying off debt. The app also offers personalized financial advice and tips to help you stay on track. As one of the best budgeting apps for ADHD, Monarch Money simplifies financial planning and goal setting.

One of Monarch Money’s standout features is its financial planning tools. You can set up customized budgets and financial goals, such as saving for a vacation or paying off debt. The app also offers personalized financial advice and tips to help you stay on track.

PocketGuard

PocketGuard simplifies budgeting by showing you exactly how much you can spend, but it operates on a subscription-only model. It’s recognized as one of the best budgeting apps for ADHD due to its clear focus on spendable income.

Pros:

- Simple, clear interface.

- Focuses on spendable income.

- Bank-level security.

- Tracks spending and helps identify saving opportunities.

Cons:

- Subscription-based.

- Limited customization without premium features.

PocketGuard is great for those who want to see their available spending money at a glance. The app calculates your “In My Pocket” amount by subtracting upcoming bills, goals, and necessities from your income. This feature can be particularly useful for individuals with ADHD who may struggle with tracking their spending.

PocketGuard also offers spending insights, helping you identify areas where you might be overspending. The app categorizes your expenses and provides charts and graphs to visualize your spending patterns. Additionally, you can set spending limits for specific categories and receive alerts when you’re nearing your limit. For those seeking the best budgeting apps for ADHD, PocketGuard offers simplicity and clarity.

Goodbudget

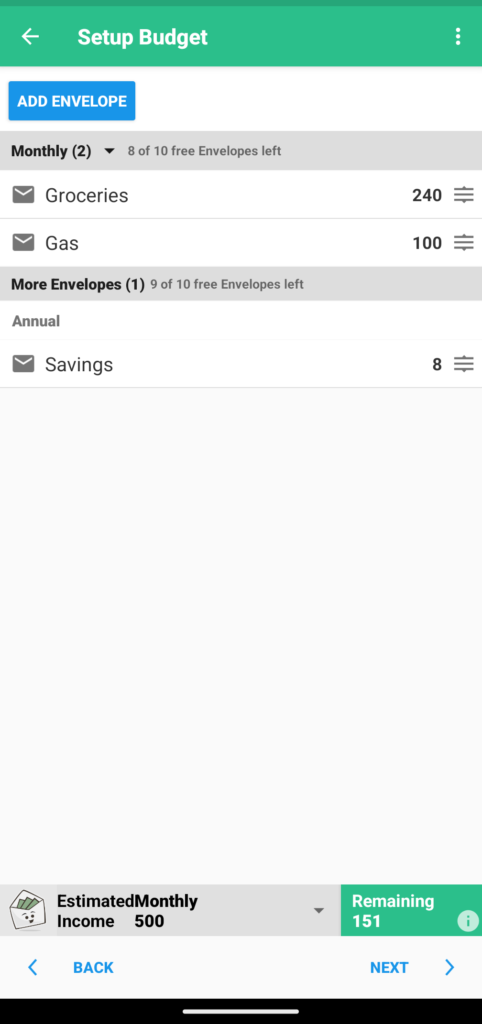

Goodbudget uses the envelope system to help you manage your money and is highly regarded as one of the best budgeting apps for ADHD.

Pros:

- Uses proven envelope budgeting method.

- Syncs across devices.

- Free and paid versions available.

Cons:

- Manual data entry required.

- Limited bank syncing.

Goodbudget is ideal for those who prefer a traditional envelope budgeting approach. Instead of physical envelopes, you create digital envelopes for different spending categories. This method can help individuals with ADHD visualize their budget and prevent overspending.

The app allows you to set up monthly budgets, track expenses, and sync your budget across multiple devices. Goodbudget also offers detailed reports to help you analyze your spending habits and make informed financial decisions. The free version includes 10 regular envelopes and 10 annual envelopes, while the paid version offers unlimited envelopes and additional features. Goodbudget’s envelope system makes it one of the best budgeting apps for ADHD.

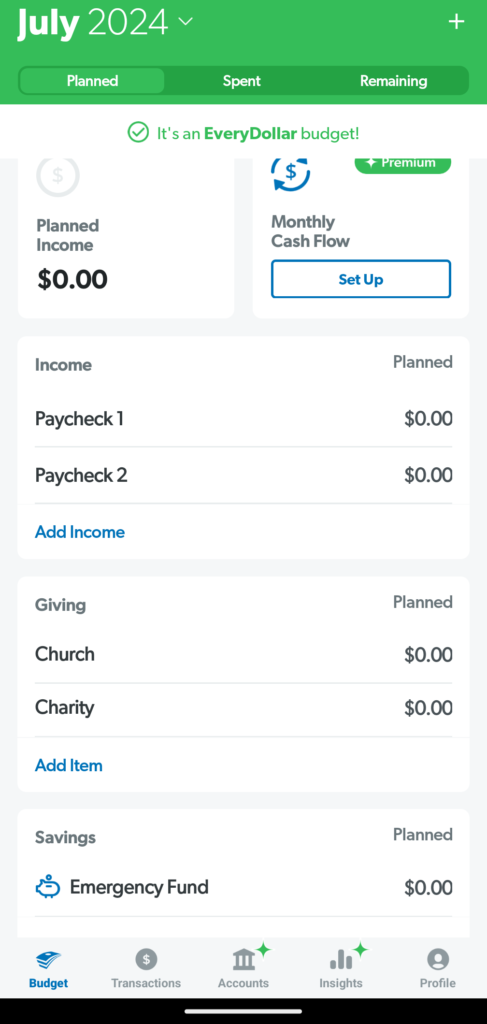

EveryDollar

EveryDollar, created by Dave Ramsey, focuses on zero-based budgeting and is among the best budgeting apps for ADHD.

Pros:

- Zero-based budgeting approach.

- User-friendly design.

- Syncs with your bank (premium version).

Cons:

- Limited features in the free version.

- Premium version can be pricey.

EveryDollar’s structured approach is perfect for those who want to account for every dollar. The app guides you through creating a budget by assigning every dollar a job, ensuring that your income equals your expenses. This method can be particularly beneficial for individuals with ADHD as it promotes accountability and reduces impulsive spending.

The free version of EveryDollar allows you to create and track your budget manually, while the premium version (EveryDollar Plus) offers bank syncing and other advanced features. The app also provides access to Dave Ramsey’s financial resources and community support, which can be valuable for individuals looking to improve their financial literacy. EveryDollar’s zero-based approach solidifies its place among the best budgeting apps for ADHD.

Conclusion

Choosing the right budgeting app can transform how you manage your finances, especially if you have ADHD. Whether you prefer YNAB’s detailed approach, Monarch Money’s comprehensive financial overview, PocketGuard’s simplicity, Goodbudget’s envelope system, or EveryDollar’s structured method, there’s an app out there to suit your needs. Explore these options and find the best budgeting apps for ADHD that fit your lifestyle and financial goals.

External Links:

Internal Links: